Global Electronic Security Market 2025 - Players, Regions, Product Types, Application & Forecast Analysis

Global Electronic Security Market 2025 - Players, Regions, Product Types, Application & Forecast Analysis

Global Electronic Security Market 2025 - Players, Regions, Product Types, Application & Forecast Analysis

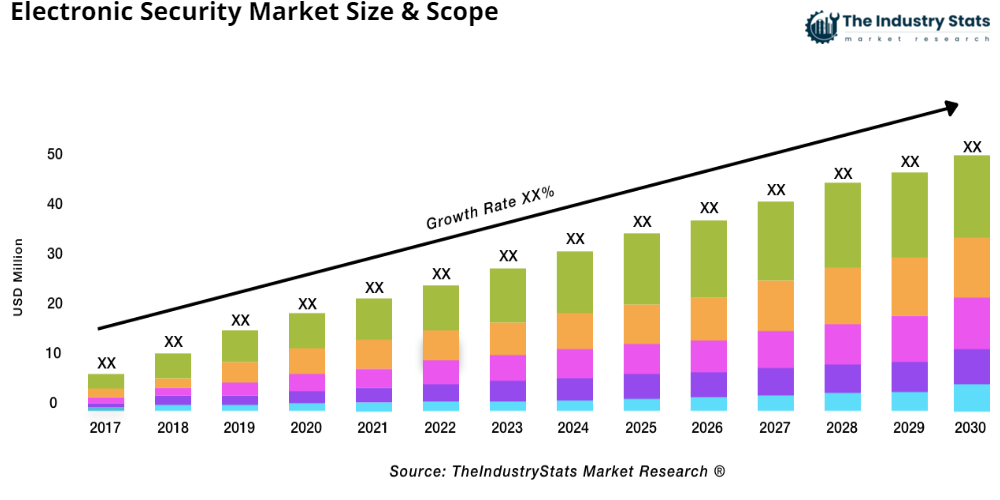

The global Electronic Security Market size reached XX USD Million in 2024. Looking forward, theindustrystats expects the market to reach XX USD Million by 2030, exhibiting a growth rate (CAGR) of XX% during 2025-2030.

Introduction of the Electronic Security Market

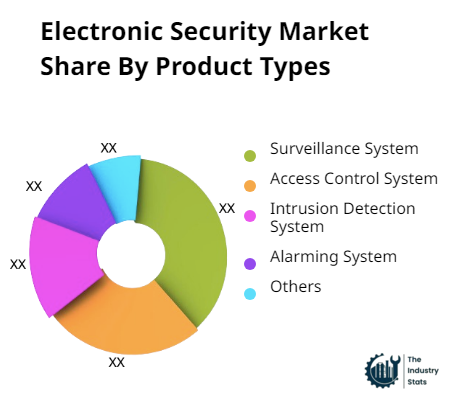

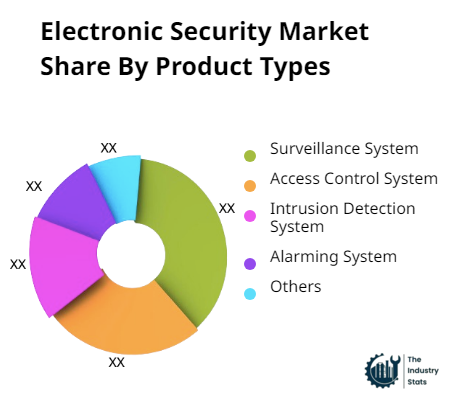

The Electronic Security Market is anticipated to experience significant growth between 2025 and 2030, driven by advancements in technologies and the increasing demand. The market includes various types of Electronic Security, such as Surveillance System, Access Control System, & Others. Sales are conducted through multiple channels, including direct sales and distribution networks. The report provides comprehensive insights into regional and global market opportunities, offering detailed analyses of key market segments, trends, and the competitive landscape over the forecast period.

Report Highlights

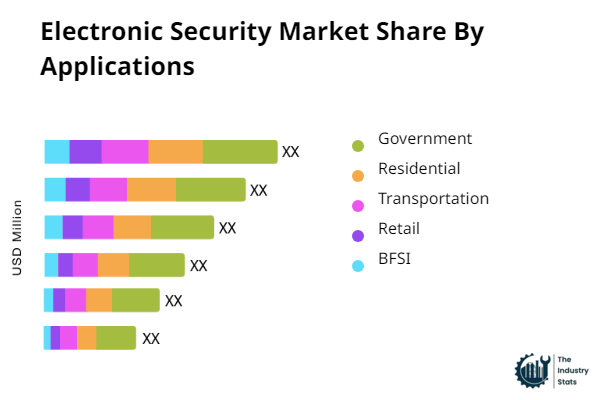

Market Segmentation: The market is divided into segments based on product types (Surveillance System, Access Control System, etc) and applications (Government, Residential, etc), with insights into sales, revenue, and market share for each segment.

Market Dynamics: Explore the factors propelling market growth, including technological advancements, economic drivers, and challenges. The report employs analytical tools like Porter’s Five Forces to provide a nuanced understanding of market forces.

Competitive Analysis: Understand the strategic moves and innovations of major market players, their market positioning, and competitive strategies. This section offers a detailed look at the strategies and developments shaping the competitive landscape.

The Electronic Security Market report presents an in-depth analysis of industry trends and growth prospects, identifying strategic opportunities for businesses to leverage evolving market dynamics.

Leading Market Players

The report includes a detailed analysis of both established and emerging companies in the market. It highlights key players based on their innovative capabilities and market influence, such as Johnson Controls, Axis Communications (Canon), Siemens, Hikvision, Panasonic, SECOM, Dahua Technology, Hanwha Vision, Sony, Hitachi, Uniview Technologies, ADT Security Services, FLIR Systems, Others, emphasizing their roles in shaping market trends and dynamics.

(Note: The list of players mentioned here is not final. We encourage you to request a sample report to review the most up-to-date list of all relevant players.)

Market Segments

Products Types Analysis

- Surveillance System

- Access Control System

- Intrusion Detection System

- Alarming System

- Others

Applications Analysis

- Government

- Residential

- Transportation

- Retail

- BFSI

(Note: The segmentation provided in this report is not limited to these categories. We can further break down the data into additional segments as per your specific requirements. We encourage you to request a sample report to explore the detailed scope of our research and customized insights.)

Sales Channel Analysis

- Direct Channel

- Distribution Channel

Market segment by Region/Country including:

- North America (United States, Canada, Mexico)

- Europe (Germany, United Kingdom, France, Italy, Russia, Spain, Benelux, Poland, Austria, Portugal, Rest of Europe)

- Asia-Pacific (China, Japan, Korea, India, Southeast Asia, Australia, Taiwan, Rest of Asia Pacific)

- South America (Brazil, Argentina, Colombia, Chile, Peru, Venezuela, Rest of South America)

- Middle East & Africa (UAE, Saudi Arabia, South Africa, Egypt, Nigeria, Rest of Middle East & Africa)

Research Methodology

The report offers a detailed examination of the Electronic Security Market, analyzing historical, current, and future trends. A rigorous research methodology, including both primary and secondary research along with expert insights, is used to develop precise market forecasts. It takes into account various economic, regulatory, and technological factors influencing the market.

Supply Chain Analysis

The supply chain analysis reviews the flow of goods from suppliers to end-users, highlighting the role of manufacturers, distributors, and retailers. This section identifies opportunities for operational improvements and strategic partnerships to enhance market competitiveness.

Pricing Trends

This section analyzes historical and projected pricing trends, offering valuable insights for businesses to craft competitive pricing strategies. By examining both quantitative data and market sentiment, businesses can optimize pricing models for better market positioning and profitability.

Competitive Landscape & Company Insights

The report delves into a comprehensive evaluation of leading companies in the Electronic Security Market, focusing on their products, financial performance, strategic initiatives, and global reach. This section helps stakeholders understand the competitive dynamics and identify areas for collaboration and competition.

The analysis begins with an overview of top companies, assessing their product portfolios and financial health. Key strategic initiatives such as product innovations, market expansions, and partnerships are highlighted. The report includes a SWOT analysis to evaluate strengths, weaknesses, opportunities, and threats, pinpointing areas for growth and improvement. It covers recent developments, partnerships, mergers, acquisitions, and product launches, illustrating the market's dynamic nature. Companies’ regional strategies and market penetration are also examined, offering insights into their geographic and industry influence. The company list can be customized to meet specific client needs, providing tailored insights into the competitive landscape.

Regional and Industry Footprint

This section explores the geographic presence and industry influence of each key player, detailing their operational regions and market sectors served. It provides a comprehensive view of their strategic positioning and market impact.

Import-Export Analysis

The report offers an in-depth import-export analysis across major regions, including North America, Europe, Asia-Pacific, South America, and the Middle East & Africa, from 2017 to 2024. This section highlights the flow of Electronic Security into and out of these regions, examining trade dynamics and identifying key export and import partners. Understanding these trends helps businesses navigate global supply chains and optimize their international trade strategies.

Demand-Supply Gap Analysis

The demand-supply gap analysis provides insights into regional disparities between market demand and supply from 2017 to 2024. It covers North America, Europe, Asia-Pacific, South America, and the Middle East & Africa, highlighting areas with excess demand or surplus supply. By identifying these gaps, companies can target specific regions for growth, address unmet needs, and balance their production and distribution strategies to enhance market presence.

Scope of Report

| Base Year of the Analysis | 2024 |

|---|---|

| Historical Period | 2017-2024 |

| Forecast Period | 2025-2030 |

| Types Covered | Surveillance System, Access Control System, Intrusion Detection System, Alarming System, Others |

| Applications Covered | Government, Residential, Transportation, Retail, BFSI |

| Sales Channels Covered | Direct Channel, Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, South America, Middle East and Africa |

| Countries Covered | United States, Canada, Mexico, Germany, United Kingdom, France, Italy, Russia, Spain, Benelux, Poland, Austria, Portugal, Rest of Europe, China, Japan, Korea, India, Southeast Asia, Australia, Taiwan, Rest of Asia Pacific, Brazil, Argentina, Colombia, Chile, Peru, Venezuela, Rest of South America, UAE, Saudi Arabia, South Africa, Egypt, Nigeria, Rest of Middle East & Africa |

| Companies Covered |

Johnson Controls, Axis Communications (Canon), Siemens, Hikvision, Panasonic, SECOM, Dahua Technology, Hanwha Vision, Sony, Hitachi, Uniview Technologies, ADT Security Services, FLIR Systems, Others (Please note that the list of players mentioned here is not final. We encourage you to request a sample report to review the most up-to-date list of all relevant players.) |

Chapter 1 Electronic Security Market Overview

1.1 Electronic Security Definition

1.2 Global Electronic Security Market Size Status and Outlook (2017-2030)

1.3 Global Electronic Security Market Size Comparison by Region (2017-2030)

1.4 Global Electronic Security Market Size Comparison by Type (2017-2030)

1.5 Global Electronic Security Market Size Comparison by Application (2017-2030)

1.6 Global Electronic Security Market Size Comparison by Sales Channel (2017-2030)

1.7 Electronic Security Market Dynamics

1.7.1 Market Drivers/Opportunities

1.7.2 Market Challenges/Risks

1.7.3 Market News (Products Launch, Mergers, Acquisitions, Expansion, Agreement and Collaborations, Partnerships)

1.7.4 COVID-19 Impacts

1.7.5 Russia-Ukraine War Impacts

Chapter 2 Executive Summary

2.1 Global Electronic Security Market Snapshot

2.2 Global Electronic Security Market Volume & Revenue (2017-2024)

2.3 Global Electronic Security Market Differential Growth Potential Analysis by Type, (2017-2030) (USD Million)

2.4 Global Electronic Security Market Differential Growth Potential Analysis by Application, (2017-2030) (USD Million)

2.5 Global Electronic Security Market Differential Growth Potential Analysis by Sales Channels, (2017-2030) (USD Million)

2.6 Global Electronic Security Market Differential Growth Potential Analysis by Region, (2017-2030) (USD Million)

Chapter 3 Electronic Security Market Segment Analysis by Player

3.1 Global Electronic Security Sales and Market Share by Player (2022-2024)

3.2 Global Electronic Security Revenue and Market Share by Player (2022-2024)

3.3 Global Electronic Security Average Price by Player (2022-2024)

3.4 Players Competition Situation & Trends (2022-2024)

3.5 Conclusion of Segment by Player

Chapter 4 Electronic Security Market Segment Analysis by Type

4.1 Global Electronic Security Market by Type

4.1.1 Surveillance System

4.1.2 Access Control System

4.1.3 Intrusion Detection System

4.1.4 Alarming System

4.1.5 Others

4.2 Global Electronic Security Sales and Market Share by Type (2017-2024)

4.3 Global Electronic Security Revenue and Market Share by Type (2017-2024)

4.4 Global Electronic Security Average Price by Type (2017-2024)

4.5 Leading Players of Electronic Security by Type in 2024

4.6 Conclusion of Segment by Type

Chapter 5 Electronic Security Market Segment Analysis by Application

5.1 Global Electronic Security Market by Application

5.1.1 Government

5.1.2 Residential

5.1.3 Transportation

5.1.4 Retail

5.1.5 BFSI

5.2 Global Electronic Security Revenue and Market Share by Application (2017-2024)

5.3 Leading Consumers of Electronic Security by Application in 2024

5.4 Conclusion of Segment by Application

Chapter 6 Electronic Security Market Segment Analysis by Sales Channel

6.1 Global Electronic Security Market by Sales Channel

6.1.1 Global Electronic Security Market, by Direct Channel Market Analysis (2017-2030) (USD Million)

6.1.2 Global Electronic Security Market, by Distribution Channel Market Analysis (2017-2030) (USD Million)

6.2 Global Electronic Security Revenue and Market Share by Sales Channel (2017-2024)

6.3 Leading Distributors/Dealers of Electronic Security by Sales Channel in 2024

6.4 Conclusion of Segment by Sales Channel

Chapter 7 Electronic Security Market Segment Analysis by Region

7.1 Global Electronic Security Market Size and CAGR by Region (2017-2030)

7.2 Global Electronic Security Sales and Market Share by Region (2017-2024)

7.3 Global Electronic Security Revenue and Market Share by Region (2017-2024)

7.4 North America

7.4.1 North America Market by Country

7.4.2 North America Electronic Security Market Share by Type

7.4.3 North America Electronic Security Market Share by Application

7.4.4 United States

7.4.5 Canada

7.4.6 Mexico

7.5 Europe

7.5.1 Europe Market by Country

7.5.2 Europe Electronic Security Market Share by Type

7.5.3 Europe Electronic Security Market Share by Application

7.5.4 Germany

7.5.5 United Kingdom

7.5.6 France

7.5.7 Italy

7.5.8 Russia

7.5.9 Spain

7.5.10 Benelux

7.5.11 Poland

7.5.12 Austria

7.5.13 Portugal

7.5.14 Rest of Europe

7.6 Asia-Pacific

7.6.1 Asia-Pacific Market by Country

7.6.2 Asia-Pacific Electronic Security Market Share by Type

7.6.3 Asia-Pacific Electronic Security Market Share by Application

7.6.4 China

7.6.5 Japan

7.6.6 Korea

7.6.7 India

7.6.8 Southeast Asia

7.6.9 Australia

7.6.10 Taiwan

7.6.11 Rest of Asia Pacific

7.7 South America

7.7.1 South America Market by Country

7.7.2 South America Electronic Security Market Share by Type

7.7.3 South America Electronic Security Market Share by Application

7.7.4 Brazil

7.7.5 Argentina

7.7.6 Colombia

7.7.7 Chile

7.7.8 Peru

7.7.9 Venezuela

7.7.10 Rest of South America

7.8 Middle East & Africa

7.8.1 Middle East & Africa Market by Country

7.8.2 Middle East & Africa Electronic Security Market Share by Type

7.8.3 Middle East & Africa Electronic Security Market Share by Application

7.8.4 UAE

7.8.5 Saudi Arabia

7.8.6 South Africa

7.8.7 Egypt

7.8.8 Nigeria

7.9.9 Rest of Middle East & Africa

7.9 Conclusion of Segment by Region

Chapter 8 Profile of Leading Electronic Security Players

8.1 Johnson Controls

8.1.1 Company Snapshot

8.1.2 Product/Service Offered

8.1.3 Business Performance (Sales, Price, Revenue, Gross Margin and Market Share)

8.1.4 Recent Developments

8.2 Axis Communications (Canon)

8.2.1 Company Snapshot

8.2.2 Product/Service Offered

8.2.3 Business Performance (Sales, Price, Revenue, Gross Margin and Market Share)

8.2.4 Recent Developments

8.3 Siemens

8.3.1 Company Snapshot

8.3.2 Product/Service Offered

8.3.3 Business Performance (Sales, Price, Revenue, Gross Margin and Market Share)

8.3.4 Recent Developments

8.4 Hikvision

8.4.1 Company Snapshot

8.4.2 Product/Service Offered

8.4.3 Business Performance (Sales, Price, Revenue, Gross Margin and Market Share)

8.4.4 Recent Developments

8.5 Panasonic

8.5.1 Company Snapshot

8.5.2 Product/Service Offered

8.5.3 Business Performance (Sales, Price, Revenue, Gross Margin and Market Share)

8.5.4 Recent Developments

8.6 SECOM

8.6.1 Company Snapshot

8.6.2 Product/Service Offered

8.6.3 Business Performance (Sales, Price, Revenue, Gross Margin and Market Share)

8.6.4 Recent Developments

8.7 Dahua Technology

8.7.1 Company Snapshot

8.7.2 Product/Service Offered

8.7.3 Business Performance (Sales, Price, Revenue, Gross Margin and Market Share)

8.7.4 Recent Developments

8.8 Hanwha Vision

8.8.1 Company Snapshot

8.8.2 Product/Service Offered

8.8.3 Business Performance (Sales, Price, Revenue, Gross Margin and Market Share)

8.8.4 Recent Developments

8.9 Sony

8.9.1 Company Snapshot

8.9.2 Product/Service Offered

8.9.3 Business Performance (Sales, Price, Revenue, Gross Margin and Market Share)

8.9.4 Recent Developments

8.10 Hitachi

8.10.1 Company Snapshot

8.10.2 Product/Service Offered

8.10.3 Business Performance (Sales, Price, Revenue, Gross Margin and Market Share)

8.10.4 Recent Developments

8.11 Uniview Technologies

8.11.1 Company Snapshot

8.11.2 Product/Service Offered

8.11.3 Business Performance (Sales, Price, Revenue, Gross Margin and Market Share)

8.11.4 Recent Developments

8.12 ADT Security Services

8.12.1 Company Snapshot

8.12.2 Product/Service Offered

8.12.3 Business Performance (Sales, Price, Revenue, Gross Margin and Market Share)

8.12.4 Recent Developments

8.13 FLIR Systems

8.13.1 Company Snapshot

8.13.2 Product/Service Offered

8.13.3 Business Performance (Sales, Price, Revenue, Gross Margin and Market Share)

8.13.4 Recent Developments

8.14 Others

8.14.1 Company Snapshot

8.14.2 Product/Service Offered

8.14.3 Business Performance (Sales, Price, Revenue, Gross Margin and Market Share)

8.14.4 Recent Developments

Chapter 9 Upstream and Downstream Analysis of Electronic Security

9.1 Industrial Chain of Electronic Security

9.2 Upstream of Electronic Security

9.2.1 Raw Materials (If Applicable)

9.2.2 Manufacturing Cost Structure (If Applicable)

9.2.3 Manufacturing Process (If Applicable)

9.3 Downstream of Electronic Security

9.3.1 Leading Distributors/Dealers of Electronic Security

9.3.2 Leading Consumers of Electronic Security

Chapter 10. Global Electronic Security Market Industry Analysis

10.1. Porter's Five Forces Analysis

10.1.1. Threat of New Entrants

10.1.2. Bargaining Power of Buyers/Consumers

10.1.3. Bargaining Power of Suppliers

10.1.4. Threat of Substitute Types

10.1.5. Intensity of Competitive Rivalry

10.2. Major Growth Avenues within Global Electronic Security Market

10.2.1. Product Types

10.2.2. Applications

10.2.3. Sales Channels

10.2.4. Country

10.3. Electronic Security Industry Ecosystem

10.4. Price Trend Analysis (If Applicable)

10.5. Buying Criteria (If Applicable)

10.6. Regulations (If Applicable)

Chapter 11 Development Trend of Electronic Security (2025 - 2030)

11.1 Global Electronic Security Market Size (Sales and Revenue) Forecast (2025 - 2030)

11.2 Global Electronic Security Market Size and CAGR Forecast by Region (2025 - 2030)

11.3 Global Electronic Security Market Size and CAGR Forecast by Type (2025 - 2030)

11.4 Global Electronic Security Market Size and CAGR Forecast by Application (2025 - 2030)

11.5 Global Electronic Security Market Size and CAGR Forecast by Sales Channel (2025 - 2030)

Chapter 12. Import - Export Analysis (If Applicable)

12.1 North America Electronic Security Import-Export (2017 - 2024)

12.2 Europe Electronic Security Import-Export (2017 - 2024)

12.3 Asia Pacific Electronic Security Import-Export (2017 - 2024)

12.4 South America Electronic Security Import-Export (2017 - 2024)

12.5 Middle East & Africa Electronic Security Import-Export (2017 - 2024)

Chapter 13. Demand-Supply Gap Analysis

13.1 North America Electronic Security Demand-Supply (2017 - 2024)

13.2 Europe Electronic Security Demand-Supply (2017 - 2024)

13.3 Asia Pacific Electronic Security Demand-Supply (2017 - 2024)

13.4 South America Electronic Security Demand-Supply (2017 - 2024)

13.5 Middle East & Africa Electronic Security Demand-Supply (2017 - 2024)

Chapter 14 Appendix

14.1 Research Methodology

14.2 Data Sources

- Methodology/Research Approach

The research study involved the extensive usage of both primary and secondary data sources. The research process involved the study of various factors affecting the industry, including the government policy, market environment, competitive landscape, historical data, present trends in the market, technological innovation, upcoming technologies and the technical progress in related industry, and market risks, opportunities, market barriers and challenges. The following illustrative figure shows the market research methodology applied in this report.

Research Programs/Design

Table Research Programs/Design

Market Size Estimation

Top-down and bottom-up approaches are used to validate the global product market size and estimate the market size for company, regions segments, product segments and application (end users).

The market estimations in this report are based on the marketed sale price of product (excluding any discounts provided by the manufacturer, distributor, wholesaler or traders). The percentage splits, market share, and breakdown of the product segments are derived on the basis of weightages assigned to each of the segments on the basis of their utilization rate and average sale price. The regional splits of the overall product market and its sub-segments are based on the percentage adoption or utilization of the given product in the respective region or country.

Major companies from the market are identified through secondary research and their market revenues determined through primary and secondary research. Secondary research included the research of the annual and financial reports of the top companies; whereas, primary research included extensive interviews of key opinion leaders and industry experts such as experienced frontline staff, directors, CEOs and marketing executives. The percentage splits, market share, growth Rate and breakdown of the product markets are determined through using secondary sources and verified through the primary sources.

All possible factors that influence the markets included in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. The market size for top-level markets and sub-segments is normalized, and the effect of inflation, economic downturns, and regulatory & policy changes or other factors are not accounted for in the market forecast. This data is combined and added with detailed inputs and analysis from research and presented in the report

The following figure shows an illustrative representation of the overall market size estimation process used for this study.

Figure Bottom-up and Top-down approaches

Market Breakdown and Data Triangulation

After complete market engineering with calculations for market statistics; market size estimations; market forecasting; market breakdown; and data triangulation, extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. In the complete market engineering process, both top-down and bottom-up approaches were extensively used, along with several data triangulation methods, to perform market estimation and market forecasting for the overall market segments and sub segments listed in this report. Extensive qualitative and further quantitative analysis is also done from all the numbers arrived at in the complete market engineering process to list key information throughout the report.

Figure Data Triangulation

- Data Source

Secondary Sources

Secondary sources include such as press releases, annual reports, non-profit organizations, industry associations, governmental agencies and customs data etc. This research study involves the usage of widespread secondary sources, directories, databases such as Bloomberg Business, Wind Info, Hoovers, Factiva (Dow Jones & Company), and TRADING ECONOMICS, and News Network, Statista, Federal Reserve Economic Data, annual reports, BIS Statistics, ICIS; company house documents; CAS (American Chemical Society); investor presentations; and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, marketoriented, and commercial study of the Product market. It was also used to obtain important information about the top companies, market classification and segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives.

Table Key Data Information from Secondary Sources

Primary Sources

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include product Company (and their competitors), opinion leaders, industry experts, research institutions, distributors, dealer and traders, as well as the raw materials suppliers and producers etc.

The primary sources from the demand side include industry experts such as business leaders, marketing and sales directors, technology and innovation directors, supply chain executive, market (product buyers), and related key executives from various key companies and organizations operating in the global market.

Primary research was conducted to identify segmentation types, product price range, product Application, key Company, raw materials supply and the downstream demand, industry status and outlook, and key market dynamics such as risks, influence factors, opportunities, market barriers, industry trends, and key player strategies.

Table Key Data Information from Primary Sources

Please share youre basic details, to recieve the report sample

We are ISO 9001:2015 recognized that ensures quality services and product delivery to our clients.

We are GDPR and CCPA compliant! Your transaction & personal information is protected from unauthorized use.